In a world that rents convenience, a software company chooses to build trust one data center, one policy, one principled decision at a time.

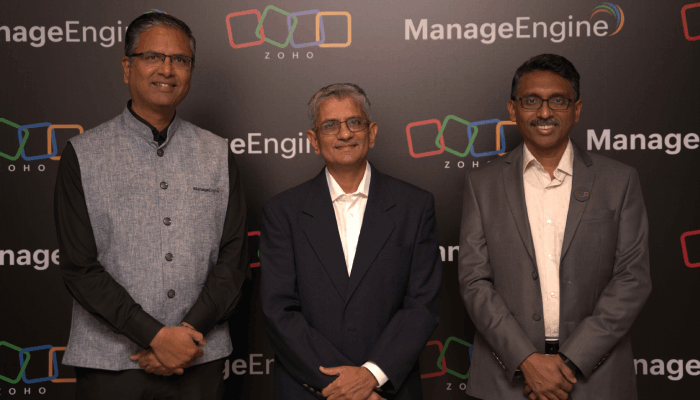

The room is barely settled when Rajesh Ganesan leans into an answer that explains a very unusual move: a software company ManageEngine has invested in building its own data center in the UAE.

Most firms in his position would choose the convenient path. They’d sign with AWS, Azure, or Google Cloud, deploy their SaaS in-region, and move on. Instead, Rajesh is quietly defiant.

“We don’t see it as inviting trouble,” he says. “We’re a technology company. If we deliver cloud software, we should know how to build and manage the cloud infrastructure.”

“We are a technology company. We don’t want to rent technology—we want to build it.”

— Rajesh Ganesan, CEO, ManageEngine

The sentence is simple. The implications are not. For ManageEngine, whose products power IT operations across enterprises enterprise service management, endpoint management, identity and access management, and more this is a principled stand: the delivery mechanism must reflect the promise the company makes to customers. And the promise is clear: your data is yours; your trust is ours to earn.

The Long Road—By Design

The story begins long before the UAE data center. Back in 2003, when SaaS was still emerging, ManageEngine made a decision: it would not grow by “reselling” hyperscale infrastructure.

“If you’re a startup today, it’s easy,” Rajesh says. “You rent compute and storage from AWS or Azure, build on top, and ship. But then what are you? A software trader reselling someone else’s cloud?”

ManageEngine chose a different identity. It embraced the long road:

- Own the stack: from custom hardware selection to custom operating system choices and custom database layers.

- Orchestrate with its own software: run and manage the platform using ManageEngine’s own tools, so real-world learnings feed directly back into product design.

- Stand behind the promise: ensure the company can honor its privacy and data commitments not by relying on another provider’s changing policies, but by owning the infrastructure decisions end-to-end.

“We can’t give a privacy promise and then depend on a third party that might change policies six months later,” Rajesh says. “We want to control the promise we make.”

Why the UAE? Sovereignty Is Not a Buzzword

For years, ManageEngine served UAE customers from data centers in the United States. It worked until the region’s strategy matured.

Government policies evolved, enterprise procurement tightened, and cloud sovereignty moved from talking point to mandate. Where data is stored, who controls it, and how it can be accessed became fundamental.

“Many of our customers here are large enterprises and government agencies,” Rajesh says. “We can no longer tell them their data will live in the US. That era is over.”

At that moment, the company faced two paths:

- Host on AWS UAE or another hyperscaler region.

- Build in the UAE and own the responsibility that comes with it.

The first path was quick and affordable, but carried an uncomfortable contradiction: ManageEngine would be making promises with someone else’s infrastructure.

The second path space, power, cooling from Equinix, and everything else designed, deployed, and governed by ManageEngine was harder. It was also the only one that aligned with the company’s character.

“We use the colocation for the basics,” Rajesh explains. “Everything else is ours the hardware, the operating system, the database, the orchestration, the monitoring and we manage it with our own software.”

This isn’t just an operational choice; it’s a statement: sovereignty is delivered, not just declared.

“Identity, endpoint, network, and infrastructure—that’s the security foundation. AI is an enabler on top.”

The Cost Myth

When a software company builds a data center, the reflexive question follows: Will this increase costs for customers? Rajesh refuses the premise. “Cost is not the first factor,” he says. “Commitment is.”

He elaborates: Good leadership doesn’t optimize purely for short-term price; it optimizes for privacy, security, compliance, and continuity. Cheap SaaS today can become an expensive incident tomorrow if the governance is weak.

But what about the bill? Here, ManageEngine’s internal operating model is telling:

- The company allocates 60% of spend to R\&D.

- It caps marketing at 18%.

- It resists a strategy of acquisitive growth.

- And it deliberately builds region-specific, right-sized infrastructure far from hyperscaler billions, close to $10 million to start.

The message to customers: we won’t pass DC costs to you. The model is built to absorb the investment without punishing the buyer. “We prefer investing in technology over field sales muscle and heavy marketing,” Rajesh says. “Our customers shouldn’t pay for our philosophy.”

Not Monopoly—But Loyalty

A bracing question follows in the interview: Is this sovereign DC strategy a path to monopolistic control locking customers into an entire ManageEngine world?

Rajesh answers with disarming candor. “Not monopoly. But yes ambition,” he says. “We want customers to buy our products and stay with us for as long as possible.”

But he frames the ambition in terms of trust and longevity, not market force. For customers that have been with ManageEngine for five years and more, the company’s trajectory is visible: deeper product features, responsible support, and now sovereign infrastructure that signals permanence. Trust, not pricing bundles. Credibility, not coercion. “We will do what our customers need from us end to end,” he says. “That’s the philosophy.”

Supply Chains, Choices, and Pragmatism

Building and operating a data center is not romantic. It’s procurement, compliance, supply chains, and the math of efficiency.

ManageEngine buys hardware from distributors rather than fabricating it. “Supply chain matters,” Rajesh says. “You buy where it’s most cost-effective and reliable. If you buy everything in-region, it might become much more expensive.” They’ll explore policy frameworks like production-linked incentives when it makes sense; they won’t claim purity points.

This isn’t about building everything, it’s about owning what matters: the design, the control plane, the data handling, and the promise.

AI: The Accelerator and the Alarm Bell

Sooner or later, the conversation turns to AI because these days it always does. Rajesh’s view balances optimism and vigilance. “AI is an enabler,” he says. “Security is the foundation.”

The hardest part of the modern CIO’s job might be this: How do I ensure the AI my enterprise uses is responsible? There is no universal answer. Enterprises will choose among OpenAI, Gemini, Meta Llama, DeepSeek, and others. ManageEngine itself has a purpose-built model for IT management tasks anomaly detection, predictions, summarization, content generation designed with bias checks and responsibility in mind.

But when customers use external models, the control shifts. That’s where ManageEngine positions itself.

“We sit in between,” Rajesh says. “We monitor what data leaves your organization, how it’s masked, who is sending it, and whether it aligns with policy.”

In other words: ManageEngine guards the enterprise boundary before data touches external AI. It can’t regulate OpenAI’s ethics. It can regulate your governance.

A Region That Moves Fast

The UAE is not just a location; it’s a signal. Sovereign cloud is becoming a regional norm, and leaders are moving fast. ManageEngine’s presence inside an Equinix facility taking only space, power, and cooling, and building everything else aligns with how the region wants to grow: sovereign, secure, modern, and self-respecting. Customers here are not waiting for global templates. They’re setting their own.

The Last Word

Before the interview wraps, Rajesh leaves two lines that could double as a north star for any organization caught between speed and substance: AI will change everything. Security will define everything.

That balance ambitious and anchoredis exactly where ManageEngine has staked its future. Not by shouting the loudest, but by building the quietest, hardest parts of the promise.

In an industry that often confuses renting with owning, ManageEngine has chosen ownership. In a world that outsources the inconvenient, it is insourcing responsibility. And in a region that is accelerating its digital sovereignty agenda, the company is making a bet that principles will compound.

It may not be the easiest path. But for customers who measure partners by what they stand behind, not just what they ship, it might be the most trustworthy one.

“Customers wanted their data local. For us, investing in the UAE was not optional—it was necessary.”

— Nirmal Kumar Manoharan, VP – Sales, ManageEngine (Zoho Corporation)

Managing Trust in the Cloud: Inside ManageEngine’s UAE Data Center Push

How a bold regional investment is reshaping cloud strategy, customer value, and competitive positioning across the Middle East.

When ManageEngine announced the launch of its new UAE data center, it was more than a technical expansion it was a strategic shift shaped by two decades of customer demand, regulatory evolution, and the company’s deepening commitment to cloud delivery. Sitting down with Nirmal Kumar Manoharan, Vice President of Sales, the rationale behind the investment becomes unmistakably clear.

For years, ManageEngine’s cloud customers in the UAE were served from the US or Europe. This model worked in the early stages of adoption, but as sectors like BFSI, government, aviation, and large enterprises matured, data sovereignty became non‑negotiable. “Customers have been asking us for years,” Nirmal says. “They wanted their cloud workloads hosted locally, and the region was ready for it.” Cloud is now ManageEngine’s primary delivery path, and hosting workloads closer to the customer is central to that vision.

Nirmal expects the UAE data center to have a direct impact on revenue. The company has consistently delivered around 20% annual growth in the region, but with local hosting now available, that number is projected to rise to 25%. As enterprises move away from managing their own servers, local cloud services become both a necessity and a competitive advantage. “Cloud adoption is accelerating everywhere,” he adds. “The UAE investment enables us to meet that demand confidently.”

The broader GCC market naturally enters the conversation. Will customers in Qatar, Bahrain, or Oman also be served from the UAE? Not immediately, Nirmal explains. Both the UAE and Saudi data centers are newly operational, and ManageEngine’s first priority is to strengthen and stabilize these two hubs. Once fully established, the company will evaluate whether the UAE should expand to serve other GCC states. For now, customers in smaller markets continue to be hosted from the US or Europe.

One distinguishing element of ManageEngine’s strategy is its complete independence from hyperscalers. The company has never run its cloud services on AWS, Azure, or GCP. “We’ve always operated our own infrastructure,” Nirmal emphasizes. “This gives us full control over data handling, compliance, and security something our customers value, especially in regulated sectors.” Earlier, most of the company’s cloud operations were managed from Chennai; with new data centers in the Middle East, operations now blend regional presence with global expertise.

The UAE data center is expected to immediately benefit three key sectors: financial institutions, which require strict data controls; government agencies, which follow sovereignty mandates; and large enterprises, which demand localized performance. “These sectors will feel the impact first,” Nirmal notes. “The combination of compliance, speed, and reliability is exactly what they’ve been waiting for.”

A project of this scale naturally requires people. ManageEngine plans to triple its Middle East headcount over the next one to two years, with extensive hiring across the UAE, Saudi Arabia, and Jordan. This includes engineering, support, Arabic‑language teams, and customer success roles—aligning with regional expectations of responsiveness and cultural proximity.

When asked about competition, Nirmal is realistic but confident. ManageEngine has built a significant customer base over the past 20 years, including major government bodies and enterprise brands. The new data center, combined with local hiring and Arabic support, positions the company strongly against global vendors. “We’re ready for a more aggressive phase,” he says.

Looking ahead, innovation remains at the core. Rather than focusing on a single new product or niche, ManageEngine evolves continuously updating features, adding modules, and expanding capabilities across its portfolio. “Our products from two years ago are not the same today,” Nirmal explains. “Continuous improvement is who we are.”

As the conversation wraps, Sanjay asks whether Nirmal is satisfied with the company’s achievements. He smiles: “Happy? Yes. Content? Never.” For 2026, his targets are clear 25% revenue growth and around 10% new customer logos in the UAE, a mature market where the focus is increasingly on value expansion rather than pure acquisition.

ManageEngine’s UAE data center is not simply an infrastructure milestone it is a strategic anchor for the company’s future in the Middle East. With deeper cloud capability, regional hiring, and longstanding customer trust, the company is poised to strengthen its leadership in one of its most important global markets.